The Basic Accounting Equation Financial Accounting

August 11, 2021What is break-even analysis, why is it important, and what are its limitations?

August 17, 2021

They should also be both subtotaled and then totaled together. However, it is common for a balance sheet to take a few days or weeks to prepare after the reporting period has ended. It is crucial to note that how a balance sheet is formatted differs depending on where the company or organization is based.

What is the approximate value of your cash savings and other investments?

- Shareholders’ equity belongs to the shareholders, whether public or private owners.

- Like any mathematical equation, the accounting equation can be rearranged and expressed in terms of liabilities or owner’s equity instead of assets.

- Therefore cash (asset) will reduce by $60 to pay the interest (expense) of $60.

Metro Corporation earned a total of $10,000 in service revenue from clients who will pay in 30 days. Metro issued a check to Office Lux for $300 previously purchased supplies on account. To learn more about the balance sheet, see our Balance Sheet Outline. Parts 2 – 6 illustrate transactions involving a sole proprietorship.Parts 7 – 10 illustrate almost identical transactions as they would take place in a corporation.Click here to skip to Part 7.

Accounting Equation Components

Balance sheets of small privately-held businesses might be prepared by the owner of the company or its bookkeeper. On the other hand, balance sheets for mid-size private firms might be prepared internally and then reviewed over by an external accountant. Although balance sheets are important, they do have their limitations, and business owners must be aware of them. It is also helpful to pay attention to the footnotes in the balance sheets to check what accounting systems are being used and to look out for red flags. The data and information included in a balance sheet can sometimes be manipulated by management in order to present a more favorable financial position for the company.

Would you prefer to work with a financial professional remotely or in-person?

When a company purchases goods or services from other companies on credit, a payable is recorded to show that the company promises to pay the other companies for their assets. Now that we have a basic understanding of the equation, let’s take a look at each accounting equation component starting with the assets. The combined balance of liabilities and capital is also at $50,000. The assets of the business will increase by $12,000 as a result of acquiring the van (asset) but will also decrease by an equal amount due to the payment of cash (asset). We will now consider an example with various transactions within a business to see how each has a dual aspect and to demonstrate the cumulative effect on the accounting equation. An asset can be cash or something that has monetary value such as inventory, furniture, equipment etc. while liabilities are debts that need to be paid in the future.

For this example, we’ll use this hypothetical balance sheet of ABC Company, an industrial manufacturer. The table below summarizes the company’s assets for the past two year-end periods. This long-form equation is called the expanded accounting equation. Almost all businesses use the double-entry accounting system because, truthfully, single-entry is outdated at this point.

Profits retained in the business will increase capital and losses will decrease capital. The accounting equation will always balance because the dual aspect of accounting for income and expenses will result in equal increases or decreases to assets or liabilities. If a company keeps accurate records using the double-entry system, the accounting equation will always be “in balance,” meaning the left side of the equation will be equal to the right side. The balance is maintained because every business transaction affects at least two of a company’s accounts. For example, when a company borrows money from a bank, the company’s assets will increase and its liabilities will increase by the same amount.

The balance sheet only reports the financial position of a company at a specific point in time. These are some of the cases in which external parties want to assess and check a company’s heroku and continuous delivery on heroku financial stability and health, its creditworthiness, and whether the company will be able to settle its short-term debts. A balance sheet lists all assets and liabilities of a company.

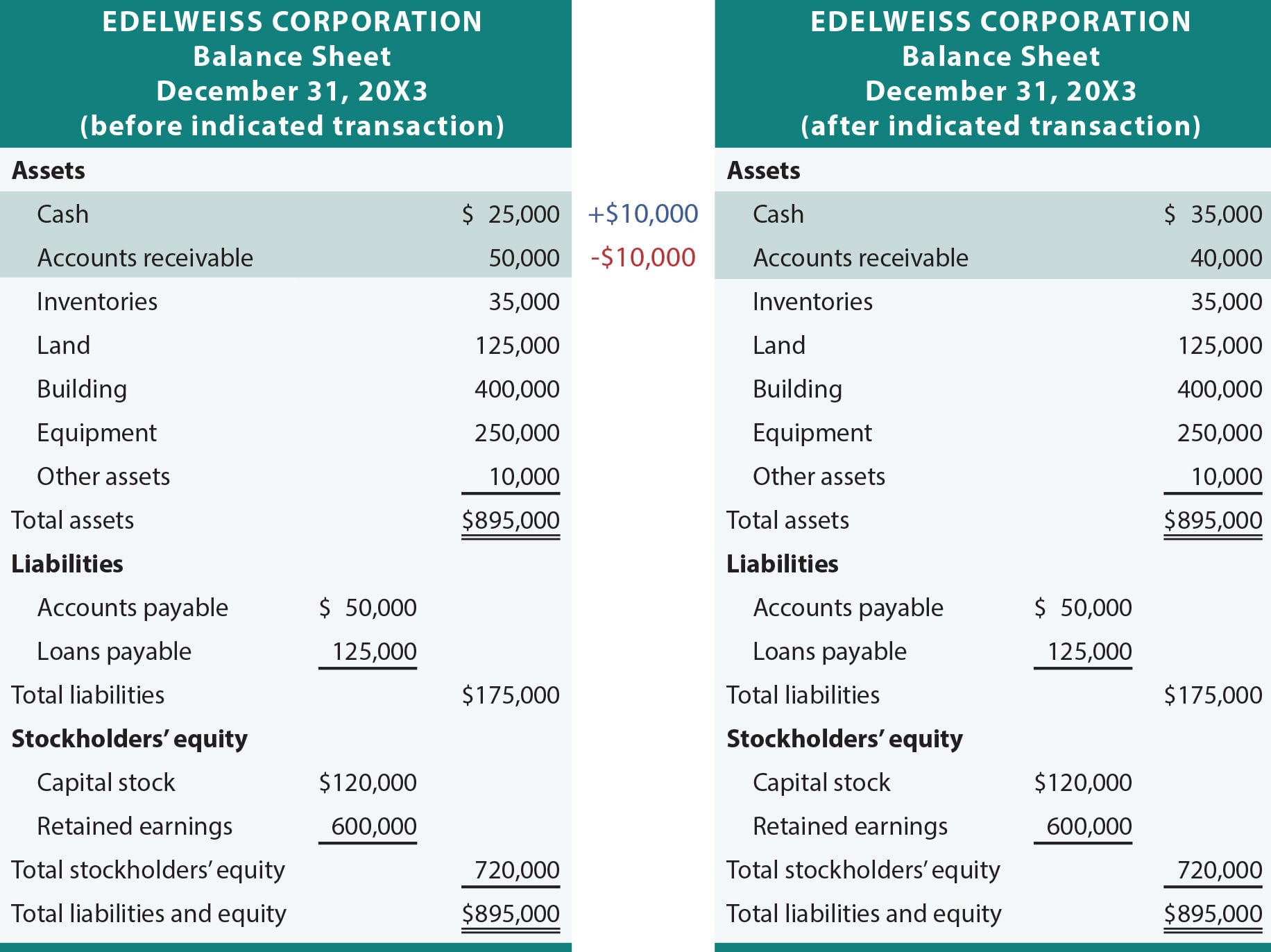

For example, if the total liabilities of a business are $50K and the owner’s equity is $30K, then the total assets must equal $80K ($50K + $30K). Does the stockholders’ equity total mean the business is worth $720,000? For example, although the land cost $125,000, Edelweiss Corporation’s balance sheet does not report its current worth. Similarly, the business may have unrecorded resources, such as a trade secret or a brand name that allows it to earn extraordinary profits. Alternatively, Edelweiss may be facing business risks or pending litigation that could limit its value.

For example, if you have a house then that is an asset for you but it is also a liability because it needs to be paid off in the future. At this point, let’s consider another example and see how various transactions affect the amounts of the elements in the accounting equation. Creditors have preferential rights over the assets of the business, and so it is appropriate to place liabilities before the capital or owner’s equity in the equation. The accounting equation is a concise expression of the complex, expanded, and multi-item display of a balance sheet.

Shareholder Equity is equal to a business’s total assets minus its total liabilities. It can be found on a balance sheet and is one of the most important metrics for analysts to assess the financial health of a company. As expected, the sum of liabilities and equity is equal to $9350, matching the total value of assets. So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved.